In unsteady economic climates, incentives become the life jacket for preserving the motivation, engagement, and productivity. By offering recognition and rewards, we’re not just lifting spirits – we’re accelerating performance even amidst the choppiest seas. Yet, as inflation continues to chew into household budgets, we find ourselves asking: are we really meeting our customers on their turf? Could the big game-changer be a daring pivot from point-based incentives to debit card rewards?

Several recent surveys, including a Gallup poll in August 2022, paint a rather grim picture of the financial stress endured by most U.S. households, thanks to inflation. This isn’t just a story of the less affluent – even high-income households feel the pinch. As prices ascend, meeting basic needs has become the main quest for individuals and families. Businesses like ours need to grasp the intensity of these pressing needs and take swift, decisive action.

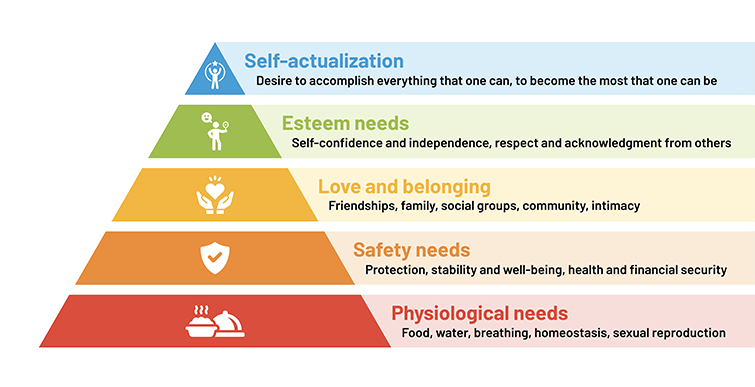

Enter Maslow’s Hierarchy of Needs theory. It suggests we must take care of basic needs before chasing loftier ones. At the pyramid’s base, you’ll find physiological and safety needs such as food, clothing, and shelter. Incentives and motivation, on the other hand, pop up at the higher rungs – think self-esteem and self-actualization. Companies must realize that their people are wrestling with foundational needs in the current economic climate.

For ages, incentives have won praise for their prowess in sparking learning and etching long-term memory. Classical conditioning, as Pavlov and Skinner showed us, tells us that administering rewards for stimuli leaves a durable imprint. Studies also say employees lean towards non-cash (or point-based) rewards. They open doors to luxuries typically off-limits, showcase “trophy value”, keep a clear line between reward and salary, and create a sense of value tied to effort. But here’s the catch: Maslow’s hierarchy tells us people can’t dwell on these high-level needs if their financial circumstances are undermining basic needs. That’s why businesses gotta be nimble and adaptable in their incentive game.

For ages, incentives have won praise for their prowess in sparking learning and etching long-term memory. Classical conditioning, as Pavlov and Skinner showed us, tells us that administering rewards for stimuli leaves a durable imprint. Studies also say employees lean towards non-cash (or point-based) rewards. They open doors to luxuries typically off-limits, showcase “trophy value”, keep a clear line between reward and salary, and create a sense of value tied to effort. But here’s the catch: Maslow’s hierarchy tells us people can’t dwell on these high-level needs if their financial circumstances are undermining basic needs. That’s why businesses gotta be nimble and adaptable in their incentive game.

The Rising Popularity of Debit Card Rewards in Today’s Economy

At Extu we’ve got our finger on the pulse of the shifting landscape and offer a dynamic alternative to point-based reward programs, ready to deploy whenever the economy throws a curveball. Our card-based programs hand recipients the freedom to resolve their immediate financial needs, right when they need it most. From single-use to reloadable or even virtual cards, Extu has got your back, offering convenience and catering to every preference and situation. We’re the pros who’ll handle everything—from distribution and management to marketing, compliance, and security. Yeah, we’ve got it all covered.

How Debit Card Rewards Empower Consumers and Businesses Alike

In the realm of incentives, debit card rewards stand out as a beacon of adaptability and immediate utility. Unlike traditional point-based systems, which often require time and effort to redeem, debit card rewards provide instant value. This immediacy is crucial in an economy where financial pressures are immediate and often severe. For businesses, this shift towards debit card rewards isn’t just about meeting immediate needs; it’s about building lasting relationships. When customers see that a company understands and responds to their current challenges, loyalty deepens. This loyalty isn’t just emotional; it’s practical. In a landscape where every dollar counts, customers remember who stood by them in tough times. Debit card rewards, therefore, are more than just a financial tool; they’re a powerful conduit for empathy and connection in a world increasingly driven by immediate needs and long-term relationships.

As businesses and individuals navigate through economic waves, reshaping incentive strategies becomes a must. Sure, point-based programs score points for their long-term effects. But the strain on basic needs calls for a more immediate response. Debit card rewards offer the elasticity to cater to these needs and provide prompt aid. We’re dialed into the ever-fluctuating economic panorama and arm businesses with the arsenal they need to keep pace with shifting needs. By embracing debit card rewards alongside time-honored incentives, you can truly back your employees and customers in rough waters, safeguarding their welfare and fueling sustained engagement for long-term triumphs. That’s how we love to roll.