Channel partners agree: spending is up

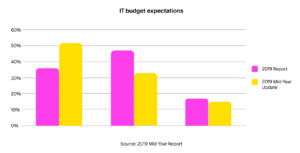

The report saw IT buyers break down their spending expectations as follows: 36 percent increase; 47 percent flat; 17 percent decrease.

The mid-year survey saw IT channel partners report a different picture: 52 percent increase; 33 percent flat; 15 percent decrease.

This is a much healthier picture than buyers predicted. It suggests partners are seeing better-than-expected growth so far in 2019. It further suggests that businesses of all types and sizes are continuing to invest in — and transform — their IT infrastructure to meet emerging security, productivity, and customer demands.

Security is pressing

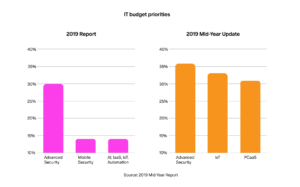

How are those budgets being spent? The report asked buyers to rank the future technologies they were most likely to invest in. The top categories were advanced security (30 percent) and mobile security (18 percent), with several categories tied for third (at 14 percent) including AI, infrastructure as a service (IaaS), internet of things (IoT), and automation.

The survey saw a slightly different result: the top categories were advanced security (36 percent) and IoT (33 percent), with PC-as-a-service (PCaaS) third (31 percent).

The congruence between the advanced security results is unsurprising. Cyberattacks remain a constant threat, and the potential cost of a breach remains uppermost in buyers’ and partners’ minds. These include business, financial, and reputational harm from the attack, as well as the legal and regulatory penalties.

Internet of what?

As IoT products become more readily available and business-friendly, it will be incumbent on partners to educate, explain, and expedite their adoption.

PCaaS is ready to fire

Finally, there is the curious case of PC-as-a-service. Buyers paid it little heed in the report, with only 12 percent planning to adopt. However, the survey saw 31 percent of partners ranking it as a technology they expect to see customers adopt.

It’s clear that despite the “as a service” model’s many advantages, the market remains unconvinced, or at least uncertain. We believe that education is needed. Anecdotes suggest, for example, that many buyers don’t understand the difference between PCaaS and a lease. But when the differences are explained, interest spikes and sales result.

Fact-based reality

Partners are seeing better-than-expected growth in 2019. Businesses understand that IT is vital to their success and that keeping their IT infrastructure up to date is critical.

Explore the Forrester Study further

Brands do not need to accept that so few of their channel partners will take advantage of their marketing platforms. Low utilization should not be a given. Instead, it is a symptom of flaws in how brands are trying to engage with partners. If you’re interested in further exploring the findings of the Forrester report, including how brands can improve the situation, check out the Forrester report in its entirety or take a look at the four additional articles we’ve published examining some of the study’s most significant findings. The next article focuses on the major challenges that partners face in executing marketing campaigns.