Incentive programs can drive engagement, loyalty, and revenue. Without a strategic approach, though, they don’t function as intended. Let’s face it—running an incentive program can be like throwing money into a black hole if you don’t plan and budget carefully. In this blog, I’ll explain how to implement cost-effective, smart incentives that deliver a return on investment (ROI) and achieve long-term success. We’ll break down the costs associated with running an incentive program, discuss budget-sharing strategies, and share strategies for measuring your program’s effectiveness. By the end, you’ll know how to make every dollar count.

Assess the Total Cost of Smart Incentives

To make smart investments in incentives, you need to understand the different costs involved. Generally, incentive program costs can be sorted into these five categories:

Rewards

The cost of rewards can vary widely. Are you giving out gift cards for a sales promotion or budgeting for each distributor to earn a percentage of rewards per sale? At Extu, we recommend setting rewards at about 2% of the distributor’s annual revenue value to you. With online or points-based programs, you can either buy reward points upfront or as participants earn them. Be smart about how you allocate these funds.

Incentive Technology

Technology costs are another biggie. Some providers might want all the money upfront, while others might have subscription models or extra features that add to the cost. Ask direct questions about this if you are working with a vendor so you know what you’re getting into.

Consultation

Don’t go it alone if you don’t have to. Consulting with incentive program experts can provide valuable insights and strategies. Choose a provider with a solid track record in your industry to maximize the success of the program you are running.

Management

Management costs can include reward fulfillment, performance monitoring, and customer support. These can vary based on the number of participants and the extent of outsourced services. Always ask about these costs upfront.

Marketing & Communication

Your incentive program needs a marketing budget to build awareness and excitement. Clear communication of program rules and objectives is crucial. Whether you go all out with a marketing campaign or keep it simple with regular emails, make sure your message is heard.

Calculate ROI with Smart Incentives

You can’t manage what you don’t measure. Use Extu’s incentive program ROI calculator to estimate your ROI based on different variables like participant size and sales targets. This helps you plan and adjust your budget so your smart incentives are working as hard as you are.

Rewards: The Heart of Smart Incentives

Here’s where your incentive program can go really wrong if you’re not careful. Offering the wrong rewards in the wrong way can blow your budget and demotivate your audience. Let’s break it down:

- Rewarding too much: Over-rewarding not only drains your budget but also desensitizes your audience.

- Not rewarding enough: On the flip side, skimping on rewards can make your audience forget about your program altogether, or reduce the effectiveness of your rewards.

- Offering the wrong rewards: No reward works for everyone all the time. Let’s look at the pros and cons of different types.

Cash or Debit Card Rewards

Pros

- Versatile and easy to distribute

- Instant impact

- Treat for short-term promotions

- Can be used internationally

Cons

- Less tangible and memorable than non-cash rewards

- Often spent on necessities, making them less memorable

- Not the best for long-term motivation

Gift Cards

Pros

- Participants are less likely to spend them on necessities, creating more memorable rewards

Cons

- Less versatile than cash or reward points

Reward Points

Pros

- Excellent for long-term motivation

- Participants can save points for big-ticket items

- Diverse reward catalogs can cater to varied tastes

Cons

- Potential liability issues if points aren’t distributed or redeemed

Group Travel

Pros

- Fantastic for top performers

- Builds relationships and provides lasting memories

Cons

- Requires significant upfront investment

Budget Sharing: A Smart Approach to Incentive Funding

Why should one department or company foot the bill for an incentive program when others benefit too? Let’s talk budget sharing.

Between Sales and Marketing Departments

Sales and Marketing both have a stake in the success of your incentive program. Sales drives revenue, while Marketing creates awareness and demand, and an incentive program helps accomplish both. It only makes sense for both departments to share the costs of the program. By pooling resources, Sales and Marketing can ensure the program is robust and impactful, without laying all the responsibilities at one department’s feet. Here are some approaches you can take:

- Fixed vs. Variable Expenses: Sales departments typically handle variable costs like rewards, while Marketing takes on fixed costs like technology setup.

- Tools and Features: Leaderboards and learning management systems that boost sales performance should fall under Sales.

- Marketing Emails: With high engagement rates, incentive program emails can provide valuable customer insights for Marketing.

- Referrals: Sales loves warm leads from referrals, so they should cover these expenses.

- Sales Data: Rewards motivate distributors to submit valuable sales data, which can help Marketing create better campaigns.

Between Your Channel Partners

Think about it—why should your company bear the entire cost of an incentive program when your channel partners also benefit? By sharing the budget with your partners, everyone involved contributes to the program’s success. This collaboration reduces program costs and builds a stronger, more unified partnership. Some ways you can co-op an incentive program with your partners:

- Offer special promotions to partner vendors who sponsor your program.

- Partner with non-competing organizations invested in your success.

- Form coalitions with other businesses to co-sponsor the program, reducing costs and increasing ROI.

- Offer bonus points for training and sales enablement efforts.

- Extend marketing opportunities to distributors backed by co-op or marketing development funds (MDF).

Measuring Success: Ensuring Your Smart Incentives Deliver

To truly benefit from your incentive program, you need to measure its success over time. This means understanding both ROI and KPIs. Let’s break it down.

- ROI (Return on Investment): This is the long-term gain you get from the program compared to what you spend. A successful incentive program should get less costly and more profitable over time. But how do you measure this success? By tracking KPIs.

- KPIs (Key Performance Indicators): These are the metrics that tell you how well your program is doing. They fall into two categories: leading indicators and lagging indicators.

Leading Indicators

Leading indicators are early signs that predict future success. They help you make adjustments before problems become serious. Here’s what to watch:

Onboarding

Look at your enrollment percentage. Are your target participants signing up? If not, dig into why. Check the average enrollment time—how quickly are participants joining after being invited? A short enrollment time means your program’s value is clear and the process is easy.

Connection

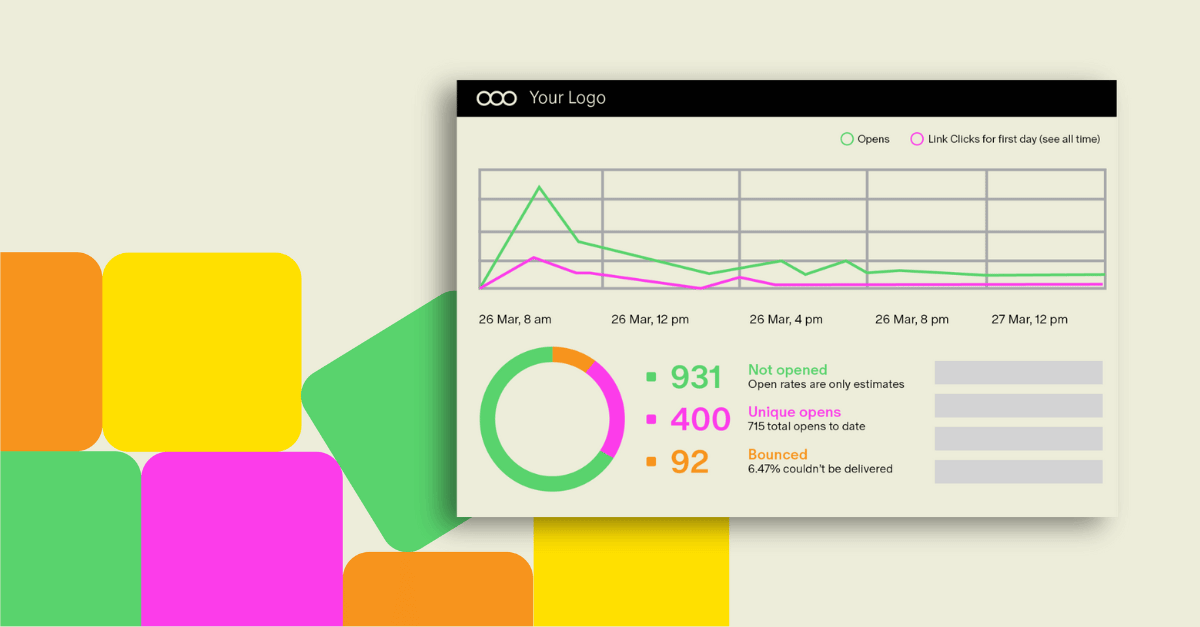

Keep an eye on email open rates. Are participants engaging with your emails? High open rates, especially for rewards-related emails, indicate your messaging is hitting the mark. Also, track email click-through rates. Are participants following up on calls to action? If they’re opening emails but not clicking through, your content might need tweaking.

Engagement

This is crucial. Measure the number of logins. How often are participants using the program? A low number might mean they’re forgetting about it. Check awards distribution. Are participants earning and using their rewards? High distribution means your incentives are working. For points-based programs, monitor reward redemption. Are participants spending their points? If not, consider a redemption marketing campaign or add an expiration date to points to create urgency.

Lagging Indicators

Lagging indicators measure the results of your efforts. They’re important for assessing overall success but come after the fact. Focus on these:

Sales Growth

Compare overall sales performance with sales driven by the incentive program. Look at the sales increase of specific products or from specific audiences. Ideally, program participants should be generating significant sales.

Average Order Size and Frequency

Are participants buying more or more often? An increase here indicates the program is influencing behavior positively.

Participant Retention Rate

Of the customers you’re keeping, how many are part of the incentive program? High retention rates among participants suggest your program is effective.

Satisfaction Surveys

Sometimes, the best insights come directly from participants. Regular surveys can reveal how they feel about the program and highlight areas for improvement.

Testimonials and Referrals

Track new business resulting from participant testimonials and referrals. This can show additional revenue attributable to your incentive program.

By focusing on these indicators, you can ensure your smart incentives are driving real, measurable success. Keep an eye on both leading and lagging indicators to adjust and improve your program continuously.

Benchmarks

If you’re not measuring your incentive program performance against industry benchmarks, you’re flying blind. Benchmarks provide a standard to aim for and help you understand where your program stands in comparison to others. They’re essential for identifying what’s working and what needs improvement. By using benchmarks, you can set realistic goals, track your progress, and make data-driven decisions to enhance your incentive program’s performance.

Let’s dive into some key benchmarks that can guide your success.

- 60% enrollees active after 1 year in closed-enrollment programs.*

- 24% enrollees active after 1 year in open-enrollment programs.*

- 128 days average enrollment time for closed-enrollment participants.*

- 62% participants receiving rewards via sales claim after 1 year.

- $500 average annual program equity amount needed to change behavior.

- 39% participants redeeming points after 1 year.

- 45% average redemption rate of distributed rewards after 1 year.

*Note: In a closed-enrollment program, program participants need an invitation to reach your incentive program enrollment page, which isn’t available to the public. In an open enrollment program, the link to your incentive program sign-up page is publicly available and anyone can join.

Final Words

By following these guidelines and implementing smart incentives, you’ll see real results without wasting resources. Make your incentive program work for you, not the other way around.